Leave a gift in your Will

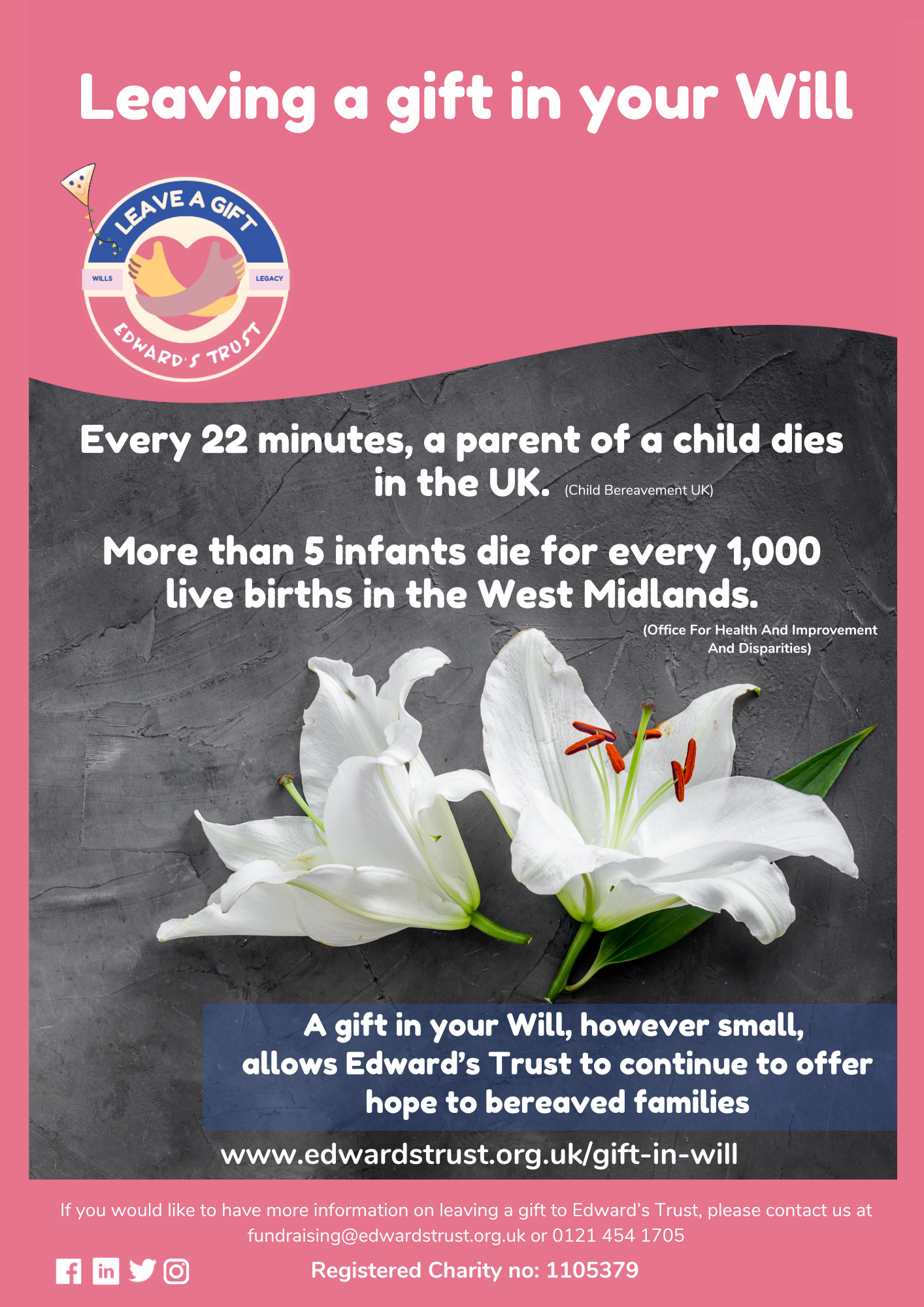

A gift in your Will helps Edward’s Trust to continue to offer hope to bereaved children, young people and parents in the West Midlands.We know that taking care of your family is the most important consideration for you when you are writing or updating your Will, but that you may also be considering benefiting causes close to your heart. We are grateful to you for considering whether leaving a gift to Edward’s Trust in your Will is right for you.

Gifts in Wills (or “legacy giving”) are an important source of income for Edward’s Trust. By leaving us a gift in your Will, , you will be helping us to continue our mission to provide holistic bereavement support across the West Midlands region.

Our vision is that one day every bereaved parent, child, young person and loved one will be responded to appropriately by friends, family, professionals, organisations and government.

By leaving a legacy to our charity in your Will, you will be helping us to achieve our vision.

Why write a Will?

It is important to know that if you die without writing a valid Will your estate will be shared out following ‘Intestacy’ law. The rules of Intestacy can be unclear and it can mean that family, friends and charities you wish to support can miss out.

A Will is one of the most important documents you will ever write, so we encourage you to seek professional advice when writing a Will. A starting guide to making a Will can be found on the government’s website here https://www.gov.uk/make-will

FAQs

What details do I need to give a gift to Edward’s Trust?

It is important that you include our full name and registered charity number.

Full name: Edward’s Trust Charity Number: 1105370

I don’t have much money – is it worth including Edward’s Trust in my Will?

Any gift from Wills will be gratefully received – they all make a difference and help Edward’s Trust support bereaved families in the West Midlands.

Does leaving a gift in my Will affect Inheritance Tax?

Gifts to charity are exempt from Inheritance Tax. This gift is deducted from your estate before tax is calculated. Inheritance Tax on the rest of your estate is reduced if you leave 10% or more to charity (correct at November 2022 – please do check this is still accurate with your professional adviser before relying on this).

I have an existing Will – if I added Edward’s Trust, would I have to re-write my Will?

You can either write a new Will including your gift to Edward’s Trust or you may be able to add a ‘codicil’ to your Will which updates your wishes and allows you to update your beneficiaries and their legacies. Please contact your solicitor to find out what is best for you.

How will you use my gift?

We will use your gift for our general charitable purposes, to supporting bereaved families across the West Midlands. Gifts in Wills have less administration costs that other types of fundraising so you can be confident that more of your money will be used to offer our frontline services.

How much do I have to pay for a Will?

Most simple Wills start at around £150. You could also take part in Free Wills Month in October each year which is funded by some well-known charities and uses solicitors from across the country. https://freewillsmonth.org.uk

Can I request my gift be used for a specific project or service?

Yes, you can specify what the money should be used for in your Will, provided it fits within Edward’s Trust’s charitable purposes. If you are considering doing this, please do feel able to call us first to discuss your thoughts so that we can ensure we feel able to carry out your wishes when the time comes.

What information do I need to prepare?

This is not an exhaustive list as a Will is different for each individual, but we would advise that starting with the following information will be helpful for you:

- Compile a list of your assets and debts including any equity in your house, savings, and any significant items you own (such as a car). Debts include any loans, outstanding mortgages and any overdrawn balances in your bank account.

- Decide who your beneficiaries are. These are people who will inherit money or items from your estate after your death. You can name specific people and it can be anyone including family members, friends, colleagues and, of course, charities like Edward’s Trust.

- Decide who your executors will be. Executors are the people legally responsible for carrying out your wishes, as laid out in your Will. They may have to apply for a court order called a Grant of Probate if your estate is of a particular size or if you have a large asset, like a house, to sell. It is common to appoint two executors but you can choose up to 4. Your solicitor will be able to advise you of all the duties and responsibilities of your executors, so you can feel confident that you are choosing the right people.

- Decide on how much you want to leave to each of your beneficiaries and the value or percentage of any gift you wish to leave to Edward’s Trust or other charities. You can decide to leave a specific amount or a percentage/share of your estate after the deduction of any legal costs, taxes or debts.

- Consider your non-financial wishes. Your Will is a place to include appointing legal guardians for any children under 18 years of age and is also the place your Executors will look to for guidance on your funeral wishes.

Contact Us

Our CEO, Clare Martin, looks after our Gifts in Wills fundraising. She will walk you through the process and is available for any questions or queries.

You can contact her on clare.martin@edwardstrust.org.uk or by calling 0121 454 1705 to arrange a call back.